VIP Indicators Review 2026

- King Peter Mantu

- Feb 2

- 7 min read

An In-Depth, Honest Review of the VIP Indicators Trading System

Can VIP Indicators really help traders make better decisions in 2026 — or is it just another over-marketed trading tool? This comprehensive review breaks down the features, accuracy claims, real user feedback, and whether VIP Indicators are actually worth using.

Why VIP Indicators Are Gaining Attention in 2026

How VIP Indicators Work on TradingView

The retail trading landscape has evolved rapidly. In 2026, traders face faster markets, more volatility, and increasing competition from algorithmic systems and institutional players. As a result, many traders are turning to AI-assisted trading indicators to simplify analysis and improve consistency.

One of the most talked-about tools in this category is VIP Indicators — a TradingView-based indicator suite that claims to help traders identify high-probability setups, manage risk, and trade with greater confidence.

VIP Indicators are marketed as an all-in-one solution for:

Forex traders

Crypto traders

Stock and index traders

Beginners and intermediate traders

But do they live up to the claims?

This VIP Indicators Review 2026 takes a clear, unbiased look at:

What VIP Indicators actually are

How the system works on TradingView

The tools included

Accuracy and performance expectations

Real user feedback

Pros, cons, and realistic use cases

This is not a hype piece — it’s a practical guide to help you decide if VIP Indicators belong in your trading toolkit.

What Are VIP Indicators?

VIP Indicators are a suite of proprietary trading indicators designed to work exclusively on TradingView, one of the world’s most popular charting platforms.

Rather than stacking multiple indicators like RSI, MACD, moving averages, and manually drawn support/resistance levels, VIP Indicators combine several analytical tools into a single, visually guided system.

The indicators aim to help traders:

Identify trend direction

Spot potential entry and exit zones

Understand momentum strength

Manage risk with clearer stop-loss and take-profit guidance

Although VIP Indicators are often described as “AI-powered,” they appear to rely on advanced algorithmic logic, volatility modeling, and trend analysis rather than fully autonomous machine learning. This distinction is important for setting realistic expectations.

Who Are VIP Indicators Designed For?

VIP Indicators are positioned as a broad-appeal trading tool, but they are particularly well-suited for certain types of traders.

Best Suited For:

Beginner traders who want structured visual guidance

Intermediate traders seeking confirmation signals

Busy traders who want faster chart analysis

TradingView users looking for an all-in-one indicator suite

Less Ideal For:

Traders expecting a fully automated trading bot

Fundamental-only traders

Advanced quants building custom strategies

VIP Indicators are best viewed as a decision-support system, not a guaranteed profit engine.

What’s Included in the VIP Indicators Suite?

VIP Indicators are not a single tool — they are a multi-indicator ecosystem. Below is a breakdown of the core components.

1. VIP Market Scanner™

The VIP Market Scanner is the foundation of the system.

What It Does:

Scans charts for potential trade setups

Highlights buy and sell opportunities

Displays suggested stop-loss and take-profit zones

Adjusts dynamically to volatility

Why It Matters:

Instead of staring at charts for hours, traders can focus on evaluating pre-qualified setups, saving time and reducing emotional decision-making.

2. Cloud Band Signals™

The Cloud Band Signals act as dynamic price envelopes, similar in concept to volatility bands.

Key Functions:

Identify potential reversal zones

Highlight trend continuation opportunities

Provide visual entry and exit cues

Strengths:

Very easy to read

Effective in trending markets

Limitations:

Can generate false signals in choppy or sideways markets

Best used alongside trend confirmation tools

3. Market Prediction Indicator™

This is the most heavily marketed — and most debated — component of VIP Indicators.

Claimed Purpose:

Provides a directional bias for upcoming price movement

Visually projects potential market direction

Important Reality Check:

While marketing materials often reference very high win rates, no indicator can predict the market with certainty. Most experienced traders treat this tool as:

A bias indicator

A confirmation layer

Not a standalone signal generator

Used responsibly, it can help align trades with momentum — but blind reliance is not recommended.

4. Trend Navigator & VIP Oscillator™

These tools help establish market context.

What They Show:

Trend direction

Momentum strength

Potential trend exhaustion

Why This Matters:

Many losing trades occur when traders go against the dominant trend. These indicators help filter out low-probability counter-trend setups.

5. Support & Resistance Matrix™

Support and resistance are core concepts in technical analysis, but drawing them manually can be subjective.

What This Tool Does:

Automatically identifies key price levels

Highlights likely reaction zones

Helps with entry, exit, and stop placement

This feature is especially helpful for newer traders still learning price structure.

VIP Indicators Feature Comparison

Feature | Purpose | Benefit |

Market Scanner | Finds trade setups | Saves time |

Cloud Band Signals | Entry/exit zones | Clear visuals |

Market Prediction | Directional bias | Momentum alignment |

Trend Navigator | Trend confirmation | Filters bad trades |

VIP Oscillator | Momentum strength | Avoids weak setups |

Support/Resistance Matrix | Key price levels | Better risk control |

Trading Course | Education | Beginner support |

Ease of Use & Setup on TradingView

One of the strongest selling points of VIP Indicators is ease of use.

Setup Experience:

Works with free TradingView accounts

Installation takes only minutes

No coding or manual configuration required

Learning Curve:

Visual signals are intuitive

Beginner tutorials are included

No indicator stacking required

👉 Want to See VIP Indicators on Your Own Charts?

The best way to evaluate any trading indicator is to see it live in real market conditions.

Educational Resources & Training

VIP Indicators include access to a beginner-friendly trading course covering:

Market structure basics

How to interpret indicator signals

Risk management principles

Practical trading examples

This added education significantly improves the value of the product, especially for traders early in their journey.

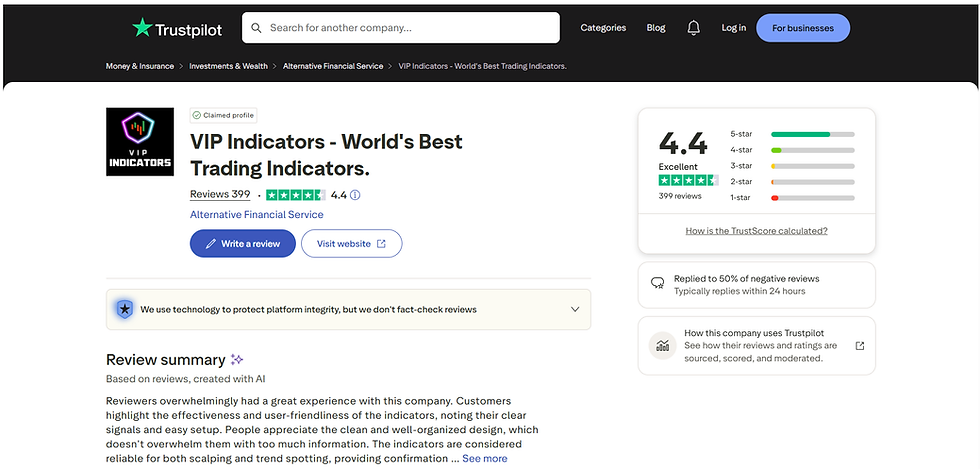

Real User Feedback: The Good and the Critical

Common Positive Feedback:

Easy-to-read signals

Reduced analysis time

Improved confidence for beginners

Clean chart visuals

Helpful customer support

Many beginners report that VIP Indicators helped them understand how price moves and why certain trades work.

Balanced & Critical Feedback:

Accuracy claims may be optimistic

Results vary between users

Performance depends on market conditions

Risk management is still essential

Experienced traders consistently emphasize that indicators do not replace discipline — a fair and important point.

VIP Indicators Accuracy: What to Expect in 2026

Let’s be realistic.

VIP Indicators Can:

✔ Improve trade timing

✔ Reduce emotional trading

✔ Provide structure

✔ Help traders follow trends

VIP Indicators Cannot:

✖ Guarantee profits ✖ Predict every market move ✖ Eliminate losses ✖ Replace proper risk management

Used correctly, VIP Indicators function best as a support system, not an automated trading bot.

Pricing, Access & Value

VIP Indicators typically offer:

Monthly subscription plans

Lifetime access options

Limited refund or trial periods

Compared to other premium TradingView indicator suites, pricing is mid-range, especially considering the included education.

👉 Want to See Current Pricing & Bonuses?

Offers and bonuses change frequently.

Pros & Cons Summary

Pros

✔ Beginner-friendly ✔ Multiple indicators in one system

✔ Works across forex, crypto, and stocks

✔ Clean visuals

✔ Includes training

✔ TradingView compatible

Cons

✖ Aggressive marketing claims

✖ No guaranteed profits

✖ Requires discipline

✖ Not fully automated

Who Should Consider VIP Indicators?

VIP Indicators are ideal for:

Beginner traders

Visual learners

Traders who want structure

TradingView users

They may not be ideal for:

Traders seeking automated bots

Those unwilling to learn risk management

Anyone expecting guaranteed returns

Final Verdict: Are VIP Indicators Worth It in 2026?

VIP Indicators are not a miracle system — but they are a well-designed trading support tool.

When used responsibly, they can:

Improve clarity

Reduce overtrading

Help traders stay aligned with trends

For beginners, VIP Indicators offer structure and confidence.For experienced traders, they provide confirmation and efficiency.

👉 Final Recommendation

If you want cleaner charts, faster analysis, and structured decision-making — and you’re willing to trade responsibly — VIP Indicators may be worth testing.

Always trade with proper risk management.

FAQ: VIP Indicators

Q: Is VIP Indicators legit in 2026?A: VIP Indicators are a real TradingView-based indicator suite used by many traders. Results vary and no profits are guaranteed.

Q: Does VIP Indicators work for crypto and forex?A: Yes, it works across any TradingView-supported market.

Q: Are VIP Indicators beginner friendly?A: Yes, especially due to visual signals and included training.

📌 Educational & Informational Disclaimer

This article is published for educational and informational purposes only and does not constitute financial advice, investment advice, trading advice, or a recommendation to buy or sell any financial instrument. Trading in financial markets — including forex, cryptocurrencies, stocks, indices, and commodities — involves substantial risk and is not suitable for all investors. Past performance of any trading indicator, system, or strategy is not indicative of future results.

VIP Indicators, like all trading tools, do not guarantee profits. Any examples, features, performance discussions, or user experiences referenced in this review are provided for educational illustration only and should not be interpreted as a promise of results. Always conduct your own independent research, test indicators on a demo account, and consider consulting with a licensed financial professional before making any trading decisions. You are solely responsible for your trading outcomes and financial decisions.

Comments